Machine Tool Selection: A Cornerstone Investment in Enterprise Production Capacity

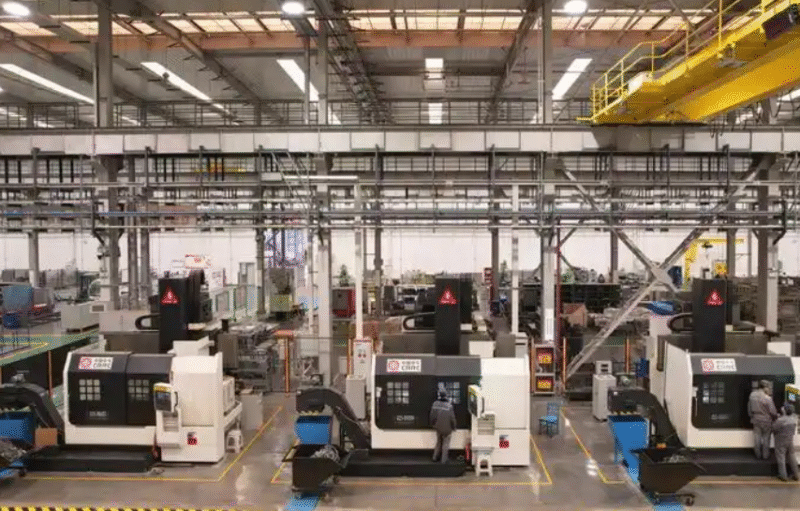

OneCNC machine toolsThe average service life of CNC machine tools extends to 15-20 years, with procurement decisions often determining a company’s manufacturing capabilities for the subsequent decade. The global CNC machine tool market is projected to reach US$100 billion by 2024. Faced with hundreds of brands and thousands of models, how can purchasers make informed decisions amidst such complexity? Industry surveys indicate that 65% of enterprises experience varying degrees of decision-making errors in machine tool procurement, resulting in an average loss of 23% of expected value. This article adopts a practical approach, delving into five core selection dimensions and providing objective comparisons of leading brands to establish a scientific decision-making framework for enterprise machine tool procurement.

Part One: Precision Performance Metrics — Practical Considerations Beyond Nominal Data

1.1 Positioning Accuracy and Repeatability

Interpretation of International Standards

ISO 230-2 Standard: The International Benchmark for Machine Tool Acceptance

Test method: Full-length measurement using a laser interferometer, with data compensated per metre.

Industry benchmark value:

Conventional machine tools: Positioning accuracy ±0.01 mm, repeatability ±0.005 mm

Precision machine tools: Positioning accuracy ±0.003mm, repeat positioning accuracy ±0.0015mm

Ultra-precision machine tools: Positioning accuracy within ±0.001mm

Practical considerations![图片[1]-购买CNC数控机床时需要考虑的五大关键指标与品牌对比-大连富泓机械有限公司](https://cndlfh.com/wp-content/uploads/2025/12/QQ20251102-193724-1.png)

Temperature influence: Nominal accuracy is typically obtained at a constant temperature of 20°C. In actual workshop conditions, variations arising from a ±2°C temperature differential must be considered (approximately 0.002 mm/m).

Full-stroke repeatability: Focusing on precision variation across the entire travel range, high-quality machine tools should exhibit a deviation of ≤150% relative to the nominal value.

Long-term stability: Accuracy decay within six months shall be ≤20%

Testing recommendations:

Require suppliers to provide third-party test reports

On-site test cutting of ISO standard specimens (such as NAS 979 specimens)

Testing accuracy retention under varying load conditions

1.2 Geometric Accuracy and Dynamic Accuracy

Key geometric error terms:

Straightness: ≤0.008 mm/m within the XY plane (Precision Grade)

Verticality: Verticality between shafts ≤ 0.008 mm/500 mm

Spindle radial runout: ≤0.003mm (near end), ≤0.006mm (at 300mm)

Dynamic precision performance:

Roundness test: Under cutting conditions, roundness of ∅100mm ≤ 0.01mm

Profile accuracy: Actual contour error in complex surface machining

High-speed precision: Accuracy degradation tested at 80% of maximum speed

Case Comparison:

A motor vehicle moulding enterprise tested three brands of machine tools of identical specifications:

Brand A (Germany): Dynamic roundness 0.008mm, price 2.8 million yuan

Brand B (Japan): Dynamic roundness 0.012mm, price ¥1.9 million

Brand C (Taiwan): Dynamic roundness 0.018mm, price 1.2 million yuan

Final selection: Procure one unit of Brand A for finishing operations and three units of Brand C for rough machining, balancing precision and cost.

Part Two: Rigidity, Power and Thermal Stability

2.1 Structural Rigidity Analysis

Bed Frame Structural Design:

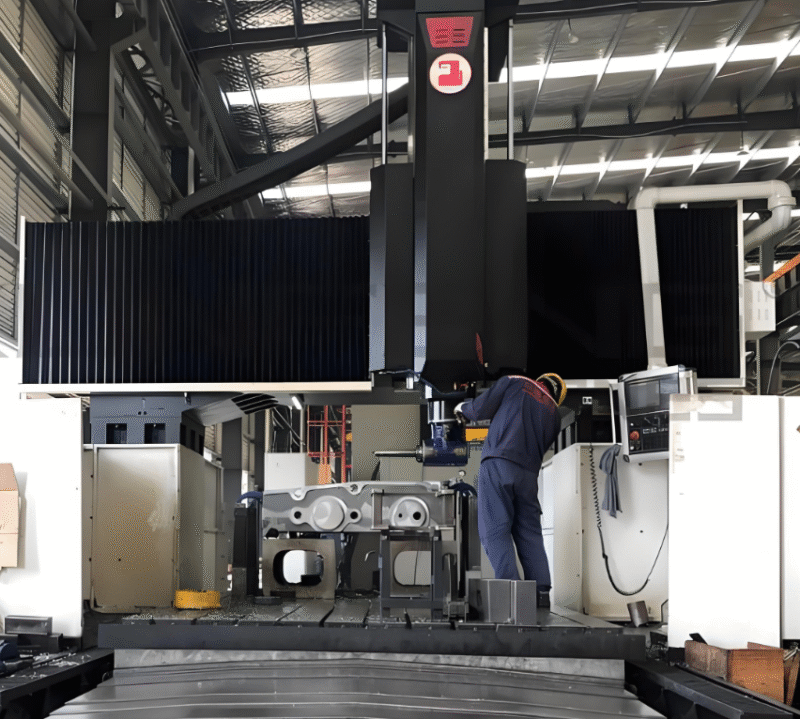

Material selection:![图片[2]-购买CNC数控机床时需要考虑的五大关键指标与品牌对比-大连富泓机械有限公司](https://cndlfh.com/wp-content/uploads/2025/12/QQ20251102-193613.png)

Cast iron: A traditional choice offering excellent damping properties (HT300 and above)

Polymer concrete: An emerging material with vibration attenuation rates 6 to 10 times higher than cast iron.

Steel plate welding: lightweight design, suitable for high-speed machine tools

Structural Optimisation: Finite element analysis optimises stiffener plate layout, achieving a top-tier brand stiffness-to-weight ratio 30-50% higher than ordinary brands.

Spindle system rigidity:

Spindle nose displacement: Deformation under rated cutting force

Typical values: Hard-rail machine tools ≤0.015mm, Linear-guide high-speed machine tools ≤0.025mm

Test method: Apply radial force and measure displacement using a dial gauge.

Guide rail and lead screw configuration:

Hard rails vs linear rails: Hard rails offer 3-5 times the load capacity, while linear rails achieve 2-3 times the speed.

Lead screw diameter: ∅40mm and above constitutes heavy-duty cutting configuration

Preload adjustment: Dual-nut preloading eliminates backlash

2.2 In-depth Assessment of Spindle Performance

Power and Torque Curve:

Constant power range: Wide range (e.g., 1:8) is preferable to narrow range.

Maximum torque: Focus on torque at low rotational speeds, such as the torque value at 200 rpm.

Overload capacity: Short-term overload capacity (e.g. 150%, 30 minutes)

Spindle Type Selection:

Gear-driven spindle: High torque, heavy-duty cutting capability, but maximum rotational speed is limited (typically ≤6000 rpm).

Direct-drive electric spindle: High rotational speed (12,000–40,000 rpm), high precision, but relatively low torque.

Hybrid spindle: Two-stage design, combining high speed with high torque

Cooling and Thermal Management:

Spindle oil cooling: Temperature control accuracy ±1°C

Adaptive adjustment of bearing preload: Mitigating thermal elongation effects

Thermal symmetry design: Reducing spindle tilt

Actual performance data comparison:

Brand/Model Power (kW) Maximum Torque (Nm) RPM Range Constant Power Range Price Range

Muye S500 22/26 140 50-12000 1:10 1.8-2.2 million

DMU50 27/34 170 30-12000 1:8 1.6-1.9 million

Hass VF4 22/26 122 50-7500 1:5 800,000-950,000

2.3 Thermal Stability Engineering

Temperature control strategy:

Critical components maintained at constant temperature: spindle, ball screw, bearings with forced cooling

Thermal symmetry design: minimising uneven thermal deformation

Environmental Adaptation: Equipped with temperature sensors for automatic compensation

Thermal drift specification:

Accuracy variation during 4-hour continuous operation: Precision machine tools ≤0.008mm

Precision variation between hot and cold operation: Premium machine tools ≤0.005mm

Ambient temperature compensation: Automatic compensation within the range of 5–35°C

Part Three: Control Systems and Intelligent Functions

3.1 Comparison of Mainstream Control Systems

Three major system factions:

Siemens SINUMERIK (Germany):

Market share: Approximately 35% of the global premium market

Advantages: Five-axis machining, turning-milling integration, digital integration

Representative models: 840D sl (high-end), 828D (mid-range)

Intelligent Functions: Adaptive Control, Process Cycle Management, Digital Twin Support

FANUC (Japan):

Market share: Approximately 45% in the global mid-to-high-end market

Advantages: High stability, excellent usability, well-established ecosystem

Representative models: 31i-B5 (high-end), 0i-F (mid-range)

Intelligent Functions: AI Thermal Compensation, AI Profile Control, Servo Optimisation

HEIDENHAIN (Germany):

Market share: Approximately 25% in the European high-end market

Advantages: Excellent human-machine interaction, high-precision control

Representative models: TNC7 (high-end), iTNC530 (mid-range)

Intelligent functions: Dynamic efficiency, collision protection, intelligent tool management

Progress in Domestic Control Systems:

Huazhong CNC: Domestic market approximately 15%, offering excellent value for money.

Guangzhou CNC: The mainstay of the budget market, with enhanced stability

Technological gap: Five-axis simultaneous control and high-speed, high-precision control still lag behind by 5-8 years.

3.2 Assessment of the Actual Value of Intelligent Functions

Adaptive control function:

Load Adaptive: Adjusts feed rate based on cutting force Typical benefits: Tool life extended by 30-50% TP3T

Vibration Suppression: Active flutter control to enhance surface finish

Thermal Compensation: Real-time Compensation Based on Models and Sensors

Predictive Maintenance System:

Spindle Health Monitoring: Bearing Condition Analysis, Early Warning

Screw Wear Prediction: Lifespan Calculation Based on Load and Stroke

Tool Monitoring: Multi-dimensional monitoring of load and acoustic emission

Digital integration capabilities:

OPC UA Interface: Enabling Data Exchange with MES/ERP Systems

Remote diagnostics: Manufacturer remote service response

Data acquisition: Automatic recording of production and quality data

Return on Investment Analysis:

Basic Intelligentisation Package: Additional investment of 8-151 million yuan, payback period of 1.5-2 years

Advanced Intelligent Package: Increases investment by 15-25%, with a payback period of 2-3 years.

Long-term value: Reducing reliance on operator experience and enhancing consistency

Part IV: Reliability, Maintainability and Service Support

4.1 Quantification of Reliability Metrics

Mean Time Between Failures (MTBF):

Industry benchmark: ≥2000 hours

Average proficiency: 1200–1800 hours

Testing Method: The manufacturer shall provide a third-party verification report.

Date of first major overhaul:

First major overhaul of the spindle: ≥20,000 hours (premium brand)

Replacement interval for guide rails and lead screws: ≥50,000 hours

Major overhaul interval: ≥60,000 hours

Actual User Data Survey (Based on Feedback from 300 Enterprises):

German brands: Average annual number of faults: 1.2 Average repair time: 3.5 days

Japanese brands: Average annual failure rate: 1.5 incidents Average repair time: 2.8 days

Taiwanese brands: Average annual failure rate: 2.3 incidents Average repair time: 4.2 days

Domestic first-tier brands: Average annual number of faults: 2.8 Average repair time: 5.5 days

4.2 Design for Ease of Maintenance

Maintainability scoring criteria:

Protective Design: Effectiveness of Guide Rail and Lead Screw Protection

Accessibility: The ease with which key components can be replaced

Modular design: Module replacement rather than repair

Diagnostic Assistance: Intelligent diagnostic system guides maintenance

Maintenance Cost Estimate:

Annual Preventative Maintenance Costs: 1.5–31% of equipment value

Spare Parts Cost Comparison: German-brand spare parts typically cost 30-50% more than Japanese-brand equivalents.

Downtime costs: £200–£800 per hour on average (depending on equipment value)

4.3 Service Support System Evaluation

Manufacturer Service Capability Metrics:

Response time: On-site response within 4 hours for critical faults

Technical Personnel Proficiency: Proportion of Certified Engineers ≥70%

Spare Parts Inventory: Local stock level for commonly used spare parts ≥85%

Training System: Systematic operational, programming, and maintenance training

Third-party service marketplace:

Independent service providers: Costs are 30-50% lower than original manufacturers, but quality varies considerably.

Remanufacturing Market: Enhancing the performance of ageing equipment at 40-60% of new machinery costs.

Part V: Total Cost of Ownership and Return on Investment Analysis

5.1 Breakdown of Initial Investment Costs

Standard configuration price range (three-axis vertical machining centre, 800×500mm worktable):

Ultra-premium (Germany/Switzerland): ¥1.8–3 million

High-end (Japan): ¥1.2–1.8 million

Mid-to-high-end (Taiwan): NT$700,000–1,200,000

Economy Class (Domestic First-Tier): ¥400,000–700,000

Entry-level (domestic second-tier): ¥200,000–400,000

Identification of Hidden Costs:

Installation and commissioning: 2-5% of equipment cost

Foundation modifications: ground load-bearing capacity, electrical systems, compressed air systems, etc.

Initial spare parts: It is recommended to stock commonly used spare parts, amounting to 3-5% of the equipment value.

Training Fees: Operational and Programming Training

5.2 Operational Cost Analysis

Energy consumption costs:

Standby power consumption: 2–5 kW

Processing energy consumption: Spindle power × Load factor × Electricity tariff

Auxiliary system energy consumption: cooling, lubrication, chip removal, etc.

Case Comparison: Annual energy consumption differences among similar equipment can reach 15–251 TP3T.

Cutting tools and consumables:

Cutting fluid: Annual consumption per machine: 3,000–8,000 yuan

Filters, etc.: Annual consumption of 2,000–5,000 yuan

Lubricating oils/greases: Annual consumption of 1,000–3,000 yuan

Personnel costs:

Operator requirements: High-end equipment necessitates operators with superior skills, commanding salaries 20-40% higher.

Programmers: Complex equipment requires specialist programmers.

5.3 Productivity and Return on Investment

Capacity Comparison Model (Taking Aluminium Alloy Component Machining as an Example):

Brand Level Average Cutting Speed Tool Change Time Positioning Time Theoretical Productivity Index

Ultra-premium 1.0 (base) 1.2 seconds 0.8 seconds 100

High-end 0.85 1.5 seconds 1.0 seconds 82

Mid-to-high-end 0.70 2.0 seconds 1.5 seconds 68

Economy Class 0.60 2.5 seconds 2.0 seconds 55

Return on Investment Calculation:

Simple payback period = Total investment ÷ Annual net benefit

Discounted payback period: Taking into account the time value of money

Case Study: A company procures a German-made machine tool for £1.6 million versus a Japanese-made machine tool for £950,000

German model: Annual additional benefit of 650,000, payback period of 2.5 years

Japanese model: Annual additional benefit of ¥480,000, payback period of 2.0 years

Taking all factors into account: opting for Japanese brands offers greater capital efficiency.

Part Six: Comprehensive Comparison of Mainstream Brands and Selection Strategies

6.1 Brand Tier Analysis

First tier: Technology leaders

Representative brands: DMG MORI, GROB, MAKINO

Core strengths: integrated solutions, complex process capabilities, digital integration

Price range: ¥1.5–5 million+

Suitable for: Aerospace, precision moulds, high-end automotive components

Second tier: Balanced performers

Representative brands: MAZAK, OKUMA, HAAS

Core strengths: High reliability, excellent value for money, global service network

Price range: ¥800,000–2,000,000

Suitable for: General machinery, automotive components, medical devices

Third tier: Value providers

Representative brands: Yeong Jin, Tongtai, FFG

Core strengths: Flexible configuration, competitive pricing, rapid delivery

Price range: ¥500,000–1,200,000

Suitable for: Small and medium-sized enterprises engaged in batch production and specialised modifications.

Fourth tier: Economical and practical models

Representative brands: Haitian Precision Machinery, Neway CNC, Shenyang Machine Tool

Core strengths: Localised service, competitive pricing, meeting fundamental requirements

Price range: £25,000–£80,000

Suitable for: Start-ups, educational institutions, simple component machining

6.2 Special Considerations for Five-Axis Machines

Comparison of Five-Axis Technology Approaches:

Dual-rotary table: Workbench rotation, suitable for small components

Swing-head type: Spindle oscillates, suitable for large components

Hybrid: turntable + pan-tilt, offering the highest flexibility

Accuracy Retention Challenges:

Rotary axis precision degradation: Requires recalibration every two years, with costs amounting to approximately £1,000–£3,000.

Dynamic accuracy: Actual contour accuracy under five-axis simultaneous motion

Test standard: VDI/DGQ 3441, ISO 10791-7

Brand Comparison:

German brands: Five-axis simultaneous machining accuracy leads Japanese brands by an average of 30%.

Price difference: For five-axis machine tools of equivalent specifications, German models command a premium of 40-60% over Japanese counterparts.

6.3 Special-purpose machine tools and production lines

Multi-spindle machine tools:

Application scenario: Mass production of symmetrical components

Efficiency improvement: 2-4 times higher than single-spindle systems

Investment Risk: Poor Adaptability to Product Changes

Turning-milling composite machine tool:

Technical Difficulty: B-axis precision, synchronisation control, programming complexity

Return on investment: reduced equipment expenditure, enhanced precision, and shortened lead times.

Leading brands: INDEX, WFL, TSUGAMI

Part Seven: Procurement Decision Process and Negotiation Strategies

7.1 Systematised Procurement Process

Phase One: Requirements Analysis and Specification Development (2–4 weeks)

Current and Future Component Analysis: Materials, Dimensions, Precision, Batch Size

Process capability requirements: Maximum cutting force, speed range, number of interlinked axes

Capacity Demand Calculation: Based on Business Forecasts for the Next 3-5 Years

Budget formulation: Total cost of ownership perspective, not merely the purchase price

Stage Two: Supplier Screening and Evaluation (3–6 weeks)

Shortlist 5-8 suppliers: covering different tiers

Technical Evaluation: On-site inspection, sample cutting tests, technical presentation

Commercial Evaluation: Pricing, Delivery, Payment, Terms of Service

User research: Visit 3–5 existing users (preferably within the same industry)

Stage Three: In-depth Negotiations and Contract Signing (2–4 weeks)

Technical Agreement: Defining Acceptance Criteria and Performance Guarantee Values

Commercial Contract: Payment Milestones, Liability for Breach, Confidentiality Clauses

Service Agreement: Response Times, Warranty Coverage, Training Content

Spare Parts List: Recommended Stock Levels and Price Locking

7.2 Key Negotiation Points and Techniques

Price Negotiation Strategy:

Obtain multiple quotes: create a competitive environment

Itemised quotation: Requires a detailed breakdown of costs to identify inflated charges.

Bulk purchasing: Negotiate discounts for multiple units (typically 5-15 units)

Off-season purchasing: Additional discounts may be available at year-end or quarter-end.

Technical Terms Negotiation:

Acceptance Criteria: Specify test methods, conditions, and acceptance criteria.

Performance guarantee: Requires a written undertaking, linked to payment.

Upgrade Path: Price Lock for Future Feature Upgrades

Training Content: Specify duration, subject matter, and number of participants

Terms of Service Optimisation:

Extended warranty period: Aiming for 24–36 months (standard 12 months)

Response time: Explicit time commitment stipulated in the contract

Spare Parts Pricing: Locking in Key Spare Parts Prices for the Next Three Years

Software Updates: Free Update Period and Subsequent Charges

7.3 Risk Mitigation Measures

Technical risks:

Sample part trial cutting: Must actually machine one’s own typical components.

Payment by instalments: Retain at least 10-20% of the final payment, to be settled upon acceptance.

Performance guarantee: Requires a performance guarantee of 5-10%.

Delivery risk:

Penalty for Delayed Delivery: Daily penalty (typically 0.05–0.11% of the contract value)

Acceptance period: Completion within a reasonable timeframe following delivery.

Domestic stock: Prioritise models with domestic stock availability.

Long-term risks:

Technology obsolescence: Consider technological trends over the next 3-5 years

Supplier stability: Assessing the financial standing of manufacturers

Exit costs: the ease of disposing of equipment and its residual value

Conclusion: Rational decision-making, strategic investment

The acquisition of CNC machine tools represents one of the most significant capital investments for an enterprise, with the quality of this decision directly impacting its manufacturing capabilities and market competitiveness for years to come. Through systematic evaluation and rational selection, businesses can maximise the value of their investment.

Specific recommendations for different enterprises:

Start-ups/Small-batch, high-variety production:

Priorities: Flexibility, ease of use, low initial investment

Recommended configuration: Taiwanese brands or domestic first-tier brands, three-axis machining centres

Investment budget: 20-30% of equipment value allocated for fixtures, cutting tools and other peripherals.

Growth-stage enterprises/medium-volume production:

Priority considerations: reliability, productivity, scalability

Recommended configuration: Mid-range Japanese brand, with optional basic automation features.

Special focus: Enhancing equipment utilisation and rapid changeover capability

Mature enterprises/mass production:

Priority considerations: overall efficiency, automation integration, quality consistency

Recommended configuration: High-end brand-specific machine or flexible manufacturing unit

Strategic Considerations: Establish strategic partnerships with suppliers and participate in equipment customisation.

Technology-driven enterprises:

Priority considerations: technological advancement, complex process capabilities, digitalisation level

Recommended configuration: Premium German brand, five-axis or mill-turn combination machine

Innovation Direction: Collaborate with manufacturers to develop new processes and establish technological barriers.

Regardless of a company’s size, remember this golden rule: the most suitable is the best. Do not blindly pursue the highest precision or fastest speed; instead, match the machine tool’s capabilities to your own product requirements, process characteristics, and staff skills.

Against the backdrop of digital transformation, modern machine tools are not merely processing equipment but also data nodes and intelligent terminals. Selecting devices with open data interfaces that support digital integration lays the groundwork for enterprises’ future smart manufacturing strategies.

Finally, it is recommended to establish a long-term mechanism for equipment procurement: formulate a 3-5 year equipment investment plan, establish standardised procurement evaluation procedures, and cultivate an internal team of equipment assessment specialists. By accumulating experience and refining standards with each procurement, equipment investment decisions can be transformed from one-off transactions into an ongoing process of building the enterprise’s core competitiveness.

暂无评论内容